|

Current. operation[edit]. Current. controversies[edit]. Fraud and abuse[edit]. Public. economics[edit]. Further. reading[edit]. System. financing[edit]. Total benefits paid, by. year[edit]. Primary Insurance Amount and Monthly Benefit Amount calculations[edit]. How workers can get estimates of benefits[edit]. Full retirement age. (FRA)[edit]. Delayed benefits[edit]. Benefits while continuing work[edit]. Spouse's benefit and government pension. offsets[edit]. Widow(er). benefits[edit]. Children's benefits[edit]. Joining and. quitting[edit]. Office of Hearings Operations (OHO, formerly. ODAR or OHA)[edit]. Benefit payout comparisons[edit]. International. agreements[edit]. Demographic and revenue. projections[edit]. Tax on wages and self-employment. income[edit]. Federal income taxation of benefits[edit]. Claim of discrimination against the poor and the middle class[edit]. Claim that politicians exempted themselves from the. tax[edit]. Comparison to a Ponzi. scheme[edit]. Estimated net benefits under differing. circumstances[edit]. Contrast with private pensions[edit]. Contrast with insurance[edit]. Private retirement. savings crisis[edit]. Court interpretation of the Act to provide benefits[edit]. Constitutionality[edit]. Fraud in the acquisition and use of. benefits[edit]. Restrictions on potentially deceptive. communications[edit]. Current. recipients[edit]. Saving behavior[edit]. Reducing cost of living adjustment (COLA)[edit]. Health. outcomes[edit]. Ways to eliminate the projected. shortfall[edit]. Wages not subject to. tax[edit]. Show

Top 1: Social Security (United States) - WikipediaAuthor: en.wikipedia.org - 104 Rating

Description: Current. operation[edit]. Current. controversies[edit]. Fraud and abuse[edit]. Public. economics[edit]. Further. reading[edit]. System. financing[edit]. Total benefits paid, by. year[edit]. Primary Insurance Amount and Monthly Benefit Amount calculations[edit]. How workers can get estimates of benefits[edit]. Full retirement age. (FRA)[edit]. Delayed benefits[edit]. Benefits while continuing work[edit]. Spouse's benefit and government pension. offsets[edit]. Widow(er). benefits[edit]. Children's benefits[edit]. Joining and. quitting[edit]. Office of Hearings Operations (OHO, formerly. ODAR or OHA)[edit]. Benefit payout comparisons[edit]. International. agreements[edit]. Demographic and revenue. projections[edit]. Tax on wages and self-employment. income[edit]. Federal income taxation of benefits[edit]. Claim of discrimination against the poor and the middle class[edit]. Claim that politicians exempted themselves from the. tax[edit]. Comparison to a Ponzi. scheme[edit]. Estimated net benefits under differing. circumstances[edit]. Contrast with private pensions[edit]. Contrast with insurance[edit]. Private retirement. savings crisis[edit]. Court interpretation of the Act to provide benefits[edit]. Constitutionality[edit]. Fraud in the acquisition and use of. benefits[edit]. Restrictions on potentially deceptive. communications[edit]. Current. recipients[edit]. Saving behavior[edit]. Reducing cost of living adjustment (COLA)[edit]. Health. outcomes[edit]. Ways to eliminate the projected. shortfall[edit]. Wages not subject to. tax[edit].

Matching search results: WebThe Social Security tax rates from 1937–2010 can be accessed on the Social Security Administration's ... Social Security benefits are calculated using a progressive benefit formula that replaces a much higher percentage of low-income workers' pre-retirement income than that of higher-income workers ... ...

Top 2: What Is Social Security Tax? Definition, Exemptions, and ExampleAuthor: investopedia.com - 124 Rating

Description: How the Social Security Tax Works . Social Security Tax for the Self-Employed . Example of Social Security Taxes . What Is the 2022 Social Security Tax Limit?. How Can I Avoid Paying Taxes on Social Security?. At What Age Is Social Security Not Taxable? Social Security tax is the tax levied on both employers and employees to fund the Social Security program in the U.S. Social Security tax is collected in. the form of a payroll tax mandated by the Federal Insurance Contributions Act (FICA)

Matching search results: WebOct 26, 2022 · Social Security Tax: A Social Security tax is the tax levied on both employers and employees to fund the Social Security program. Social Security tax is usually collected in the form of payroll ... ...

Top 3: 12 States That Tax Social Security Benefits | KiplingerAuthor: kiplinger.com - 155 Rating

Description: Sponsored Content. (opens in new tab). Sponsored Content. (opens in new tab). Sponsored Content. (opens in new tab). Sponsored Content. (opens in new tab). Sponsored Content. (opens in new tab). Sponsored Content. (opens in new tab). Sponsored Content. (opens in new tab). Sponsored Content. (opens in new tab). Sponsored Content (opens in new tab). Sponsored Content. (opens in new tab). Sponsored Content (opens in new tab). Sponsored Content. (opens in new tab) Are Soci

Matching search results: WebNov 14, 2022 · State Taxes on Social Security: Social Security benefits taxed by the federal government are excluded from taxable income for single taxpayers with federal adjusted gross income of $50,000 or less ... ...

Top 4: How Is Social Security Tax Calculated? - InvestopediaAuthor: investopedia.com - 139 Rating

Description: Social Security Tax Rates History of Social Security Tax Rates . Calculating FICA Taxes: An Example . What Is the Social. Security Withholding for 2022?. How Much Social Security Income Is Taxable?. Is OASDI the Same as Social Security?. How Much Is Social Security Taxed at Full Retirement Age?. How Much Tax Will Be Withheld From My Social Security Check? The. Old-Age, Survivors, and Disability Insurance program (OASDI) tax—more commonly called the Social Security tax—is calculated by t

Matching search results: WebNov 16, 2022 · The Social Security tax rate for both employees and employers is 6.2% of employee compensation (for a total of 12.4%). The Social Security tax rate for those who are self-employed is the full 12.4%. ...

Top 5: Understanding Social Security Benefits | The Motley FoolAuthor: fool.com - 104 Rating

Description: How Social Security works. Related Retirement Topics. Brief history of Social Security. Eligible family members include: Social Security forms an important part of most people's retirement plans, but the program itself does much more than just that. In a nutshell, Social Security is designed to support disabled and retired workers and their families by providing a guaranteed source of lifetime income for those who meet certain criteria.Here's a closer look at how the program works,. the differen

Matching search results: WebDec 31, 2022 · Learn about social security benefits, including retirement, disability, survivor benefits. ... Calculated by average return of all stock recommendations since inception of the Stock Advisor ... ...

Top 6: 2023 Social Security Tax Limit - InvestopediaAuthor: investopedia.com - 112 Rating

Description: How the Social Security Tax Works . Social Security Tax Limits . History of Social Security Tax Limits . Cost-of-Living Adjustment (COLA) . Retirement Earnings Test Exempt Amounts . Who Has to Pay Social. Security Taxes?. What Is the Social Security Tax Rate in 2023?. Why Do I Pay Social Security Tax?. What Is the Maximum Taxable Amount for Social Security Taxes?. Who Is Exempt From Paying Social Security Tax? The federal government sets a limit on how much of your income is subject t

Matching search results: WebOct 30, 2022 · The Social Security tax rate rarely changes, as employees have been paying 6.2% since 1990; however, unlike the tax rate, the Social Security tax limit is adjusted annually. ...

Top 7: How Are Social Security Spousal Benefits Calculated? - InvestopediaAuthor: investopedia.com - 170 Rating

Description: Who Qualifies for Social Security Spousal. Benefits? . How. Spousal Benefits Are Calculated . Divorced and Widowed Spouses . Spousal Benefits Loopholes . Strategies for Maximizing Spousal Benefits . How Do Social Security Spousal Benefits Work?. Can I Collect Half of My Spouse's Social Security at 62?. What Is the. Maximum Spousal Social Security Benefit?. How Can I Switch From My Social Security Benefit to a Spousal Benefit?. Full Retirement Age . Claiming Early or Late If You're Receiving Other Retirement Benefits . Same-Sex Married Couples . Spousal Benefits for Divorced Spouses . Spousal Benefits for Widows and Widowers . The File and Suspend Strategy . 1. Strategy for Late Claimers 2. Strategy for Divorced Spouses . 3. Strategy for Widowed Spouses .

Matching search results: WebOct 04, 2022 · The percentage of your spouse's Social Security that you receive starts at 32.5% at age 62 and steps up gradually to 50% at your full retirement age, 66 or 67, depending on your year of birth. ...

Top 8: The Future Financial Status of the Social Security ProgramAuthor: ssa.gov - 114 Rating

Description: Annual Reports by the Trustees. Solvency of the Social Security Program. OASI and DI Trust Funds Separately. Sustainability of Social Security. A Range of Financial Measures. Uncertainty of the Future. Actuarial Status and Budget Scoring. What is Causing the Financial Status to Show Shortfall?. Future Changes for the Social Security Program The concepts of solvency, sustainability, and budget impact are common in discussions of Social Security, but are not well understood. Currently, the Social

Matching search results: WebThe Social Security Board of Trustees project that changes equivalent to an immediate reduction in benefits of about 13 percent, or an immediate increase in the combined payroll tax rate from 12.4 percent to 14.4 percent, or some combination of these changes, would be sufficient to allow full payment of the scheduled benefits for the next 75 years. ...

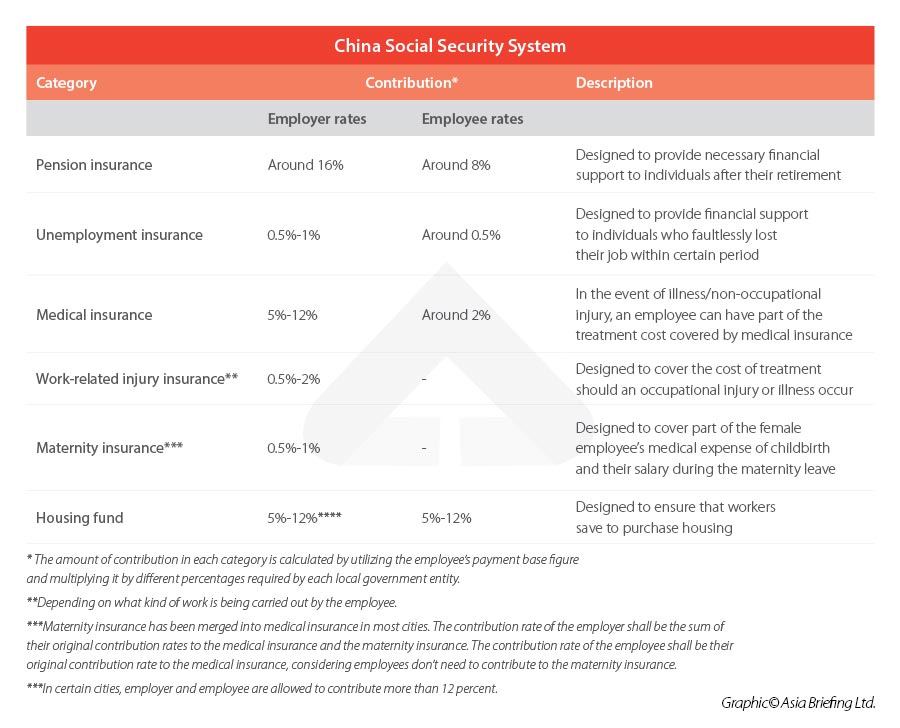

Top 9: China’s Social Security System: An ExplainerAuthor: china-briefing.com - 122 Rating

Description: China’s social security. system at a glance. What are key employer obligations in China?. How to calculate the. contribution base?. Are there local variances in how the social security system works across China?. How does the social security system impact foreigners and migrant. workers?. Is social security a burden on China’s employers? Editor’s Note: This article was originally published in September 2017. Parts of the article have been updated in September 2019 and February 2021 to reflect the

Matching search results: WebFeb 01, 2021 · China Briefing explains how social security in China is calculated, what are employer obligations, and how it impacts foreign workers and migrants. ... payments for its employees can be treated as reasonable salary expenses and thus can be deducted from corporate income tax. Secondly, social insurance can protect businesses from risks and … ...

Top 10: How Is Social Security Tax Calculated? - InvestopediaAuthor: investopedia.com - 139 Rating

Description: Social Security Tax Rates History of Social Security Tax Rates . Calculating FICA Taxes: An Example . What Is the Social. Security Withholding for 2022?. How Much Social Security Income Is Taxable?. Is OASDI the Same as Social Security?. How Much Is Social Security Taxed at Full Retirement Age?. How Much Tax Will Be Withheld From My Social Security Check? The. Old-Age, Survivors, and Disability Insurance program (OASDI) tax—more commonly called the Social Security tax—is calculated by t

Matching search results: Social Security is taxed at the same rate for everyone: 6.2% for employees and employers, for a total of 12.4%. If you are self-employed, you pay the entire ...Social Security Tax Rates · History of Social Security · Regressive Tax · MedicareSocial Security is taxed at the same rate for everyone: 6.2% for employees and employers, for a total of 12.4%. If you are self-employed, you pay the entire ...Social Security Tax Rates · History of Social Security · Regressive Tax · Medicare ...

Top 11: Income Taxes And Your Social Security BenefitAuthor: ssa.gov - 103 Rating

Description: Some of you have to pay federal income taxes on your Social Security benefits. This usually happens only if you have other substantial income in addition to your benefits (such as wages, self-employment, interest, dividends and other taxable income that must be reported on your tax return).You will pay tax on only 85 percent of your Social Security benefits, based on Internal Revenue Service (IRS) rules. If you:file. a federal tax return as an "individual" and your combined income* is between $25

Matching search results: Income Taxes And Your Social Security Benefit (En español) · between $25,000 and $34,000, you may have to pay income tax on up to 50 percent of your benefits.Income Taxes And Your Social Security Benefit (En español) · between $25,000 and $34,000, you may have to pay income tax on up to 50 percent of your benefits. ...

Top 12: Topic No. 751 Social Security and Medicare Withholding Rates - IRSAuthor: irs.gov - 101 Rating

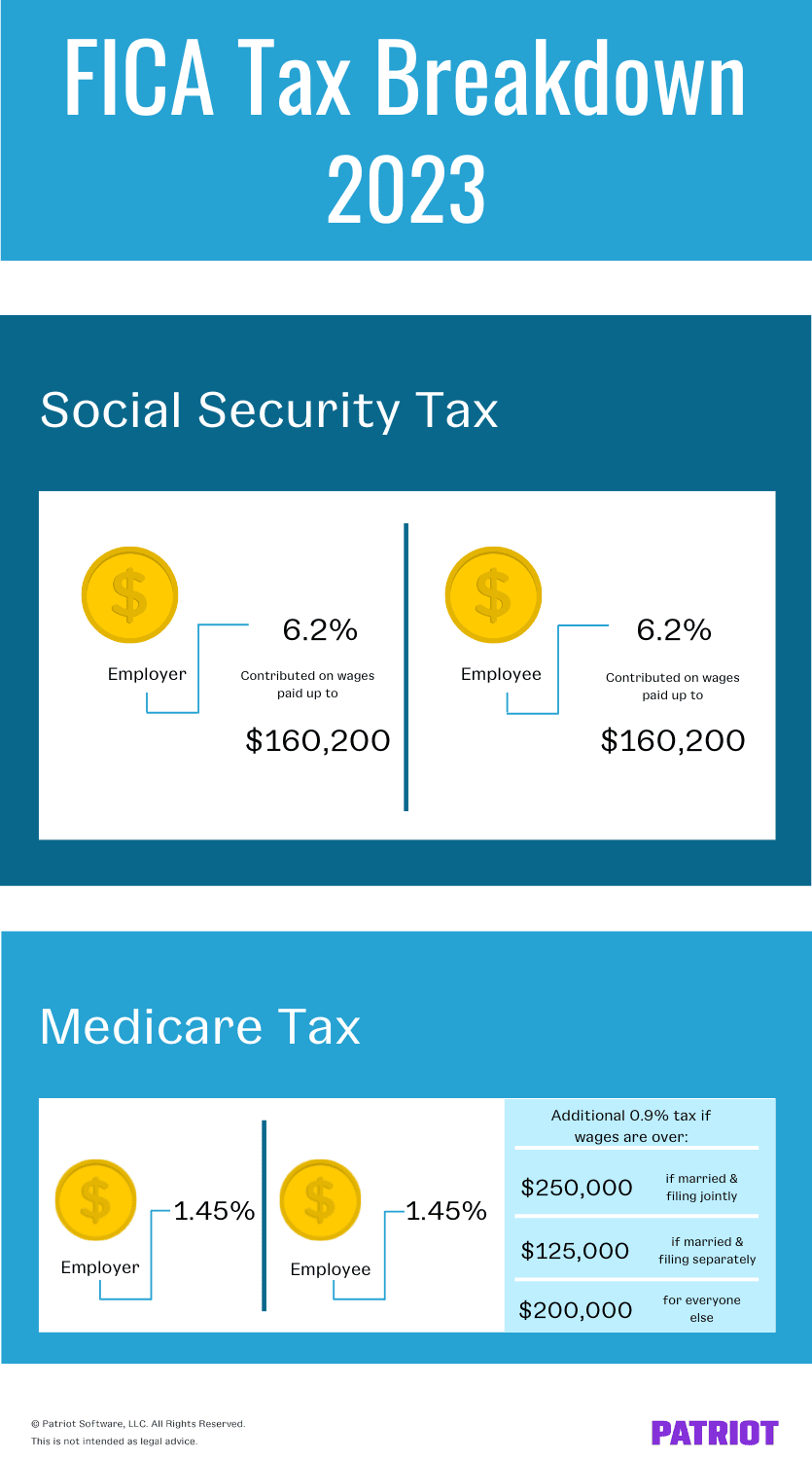

Description: Social Security and Medicare Withholding Rates. Additional Medicare Tax. Withholding Rate Taxes under the Federal Insurance Contributions Act (FICA) are composed of the old-age, survivors, and disability insurance taxes, also known as social security taxes, and the hospital insurance tax, also known as Medicare taxes. Different rates apply for these taxes.Social Security and Medicare Withholding RatesThe current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or

Matching search results: The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the ...The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the ... ...

Top 13: What Is Social Security Tax? | Calculations & ReportingAuthor: patriotsoftware.com - 128 Rating

Description: How do you calculate Social Security tax?. Where and how do you report Social Security tax?. What are Social Security taxes used for?. How much is Social Security tax?. How do you pay Social Security taxes? Employers are responsible for withholding, remitting, and filing payroll taxes on behalf of their employees. And, there are some taxes you contribute on behalf of your employees. Social Security tax is one of those essential taxes that impacts both the employer and the employee.Keep reading

Matching search results: Dec 13, 2022 · To calculate the Social Security tax, multiply the employee's gross taxable wage by the Social Security tax rate. Pay frequency does not matter.Dec 13, 2022 · To calculate the Social Security tax, multiply the employee's gross taxable wage by the Social Security tax rate. Pay frequency does not matter. ...

Top 14: Is Social Security Taxable? (2022 Update) - SmartAsset.comAuthor: smartasset.com - 125 Rating

Description: Is Social Security Income Taxable?. How to Calculate Your Social Security Income Taxes. How to File Social Security Income on Your Federal Taxes. Simplifying Your Social Security Taxes. State Taxes on Social Security Benefits. The Impact of Roth IRAs on Social Security Taxes. Tips. for Saving on Taxes in Retirement Tap on the profile icon to edityour financial details. Social Security income is generally taxable at the federal level, though whether or not you have to pay taxes on your Social

Matching search results: Dec 20, 2022 · How to Calculate Your Social Security Income Taxes · half of your annual Social Security benefits OR · half of the difference between your ...Dec 20, 2022 · How to Calculate Your Social Security Income Taxes · half of your annual Social Security benefits OR · half of the difference between your ... ...

Top 15: What Is the Social Security Tax? - SmartAsset.comAuthor: smartasset.com - 97 Rating

Description: What Is the Social Security Tax?. Why Do You Pay Social Security Tax?. Are There Ways to Avoid Social Security Tax?. Tips. for Saving for Retirement Tap on the profile icon to edityour financial details. The Social Security tax is one reason your take-home pay is less than your income. The tax of 6.2% (on income up to $147,000 in 2022 and $160,200 in 2023) is deducted from your pay and appears on your paycheck stub either as FICA or Fed. OASDI/EE. Your employer also pays 6.2%, making for

Matching search results: Nov 11, 2022 · As noted earlier, the Social Security tax is usually 12.4% of your income. In general, your employer pays 6.2% and you pay the other 6.2%. An ...Nov 11, 2022 · As noted earlier, the Social Security tax is usually 12.4% of your income. In general, your employer pays 6.2% and you pay the other 6.2%. An ... ...

Top 16: How to Calculate Your Social Security Taxes | The Motley FoolAuthor: fool.com - 152 Rating

Description: The Social Security. tax rate. How much of your income is subject to Social Security taxes?. Calculating your 2017 Social Security tax. What if you paid too much in 2016? Social Security taxes are calculated in a different manner than federal and state income taxes. In some ways, the process is much less complicated -- for example, there are no Social Security tax "brackets" -- just one rate. However, Social Security tax does not apply to all types of income, and is calculated differently for se

Matching search results: Mar 17, 2017 · If you're an employee, the calculation is pretty simple. First, write down (or type into a calculator) the lower of your total wages or $127,200 ...Mar 17, 2017 · If you're an employee, the calculation is pretty simple. First, write down (or type into a calculator) the lower of your total wages or $127,200 ... ...

Top 17: How To Calculate FICA Tax - PaycorAuthor: paycor.com - 108 Rating

Description: Last Updated: February 24, 2020 | Read Time: 1 minThe FICA tax (Federal Insurance Contribution Act) tax is an employee payroll tax that funds Social Security benefits and Medicare health insurance. The tax is split between employers and employees. They both pay 7.65% (6.2% for Social Security and 1.45% for Medicare) of their income to FICA, the combined contribution. totaling 15.3%. The maximum taxable earnings for employees as of 2020 is $137,700. There is no wage limit for Medicare.FICA Tax Cal

Matching search results: Feb 24, 2020 · To calculate FICA tax contribution for an employee, multiply their gross pay by the Social Security and Medicare tax rates.Feb 24, 2020 · To calculate FICA tax contribution for an employee, multiply their gross pay by the Social Security and Medicare tax rates. ...

|

Related Posts

Advertising

LATEST NEWS

Advertising

Populer

Advertising

About

Copyright © 2024 berikutyang Inc.